KORIX delivers adaptive AI trading through a network of 90 specialized bots, engineered to navigate market regime changes with precision and discipline.

No hype. No screenshots. Just transparent, real-time performance data and a system built for regime change.

Most trading systems fail when market conditions shift. They're optimized for one regime and collapse in another.

KORIX is built for regime change. Our AICT system deploys 90 specialized bots that adapt in real-time, ensuring stability across volatile, trending, and ranging markets.

This isn't about chasing returns. It's about engineering consistent performance through intelligent diversification and adaptive execution.

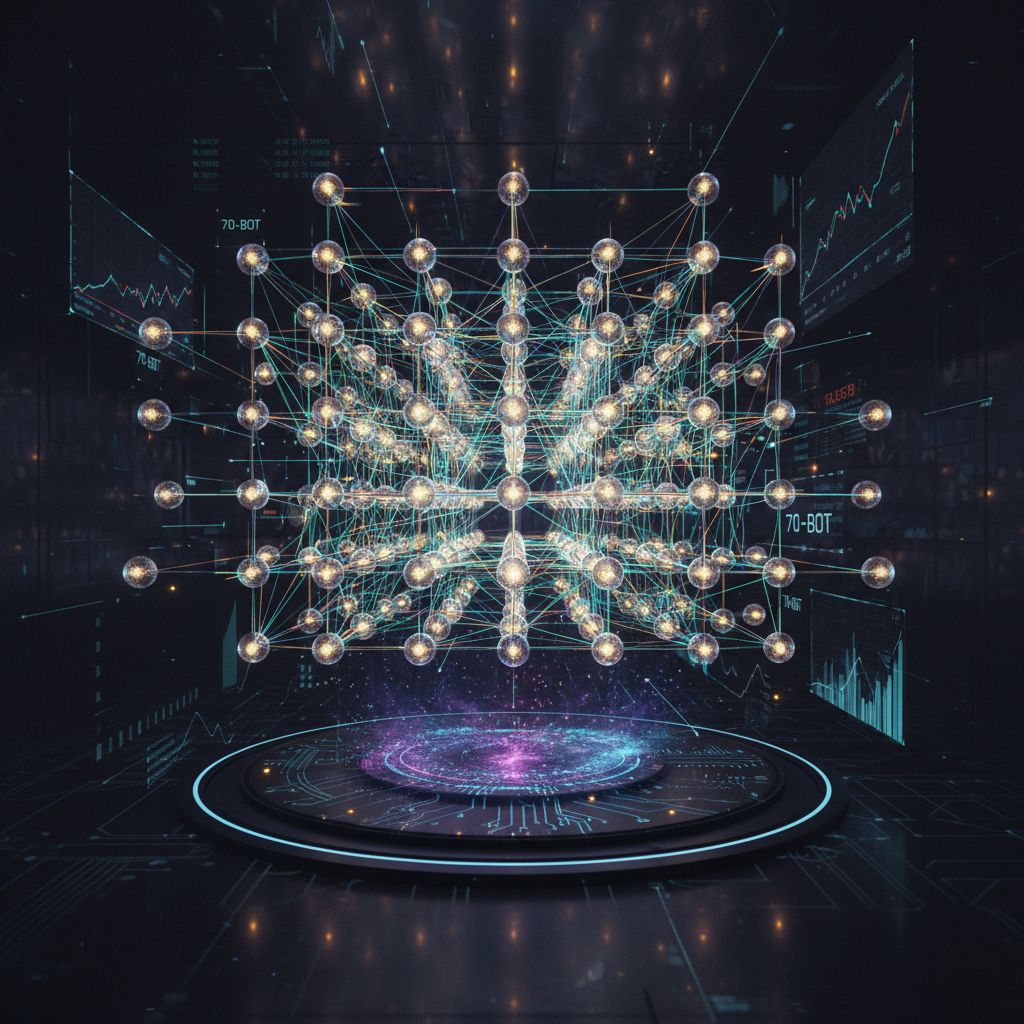

AICT (Adaptive Intelligence Collective Trading) is our proprietary system that orchestrates 90 specialized trading bots to navigate any market condition. Each bot is designed for specific regimes, working together to deliver consistent, risk-adjusted returns.

Link your trading account securely through our platform.

Select from Steady, Momentum, or Pinnacle based on your goals.

Let the 90-bot network execute adaptive strategies automatically.

The AICT system operates through a four-phase adaptive cycle, ensuring your capital is always deployed optimally.

Our AI continuously analyzes market conditions, identifying regime shifts and volatility patterns across multiple timeframes and asset classes.

Based on current conditions, AICT dynamically allocates capital across the 90-bot network, activating specialists optimized for the detected regime.

Bots execute trades with precision timing, managing position sizing, entry/exit points, and risk parameters in real-time without human intervention.

Continuous monitoring ensures portfolio-level risk stays within defined parameters, with automatic rebalancing and protective measures activated as needed.

Our network consists of 90 specialized trading bots, each engineered for specific market conditions. Together, they form an adaptive intelligence that responds to any regime.

70 bots focus on core strategies (trend following, mean reversion, volatility), while 20 regime detectors continuously monitor market structure to trigger optimal bot allocation.

This architecture ensures we're never caught off-guard by regime shifts, maintaining performance consistency across all market conditions.

Specialized in identifying and riding sustained directional moves across multiple timeframes.

Exploit price deviations from statistical norms, capturing profits as markets return to equilibrium.

Thrive in high-volatility environments, using advanced options strategies and dynamic hedging.

Optimized for sideways markets, profiting from predictable oscillations within defined boundaries.

Monitor market structure continuously, signaling transitions and triggering bot reallocation.

We're not another trading bot. We're a complete adaptive intelligence system built on principles of diversification, transparency, and disciplined execution.

Unlike static systems, AICT dynamically reallocates across 90 bots based on real-time market conditions.

Full transparency into bot performance, allocation decisions, and risk metrics through our live dashboard.

Portfolio-level controls ensure drawdowns stay within defined limits, with automatic protective measures.

We only profit when you do. No management fees—just performance-based alignment.

Built on enterprise-level technology with redundancy, security, and execution speed at the core.

Our AI learns and adapts, with regular bot optimization and strategy refinement based on performance data.

Our name embodies the principles that drive every decision, every algorithm, and every trade.

Built on deep market understanding and quantitative research, our system leverages decades of trading wisdom encoded into algorithmic intelligence.

Continuous refinement of strategies, risk parameters, and bot allocation ensures peak performance across all market conditions.

Engineered to withstand market shocks and regime changes, maintaining stability when other systems fail.

Adaptive AI that learns from every trade, every market shift, evolving to stay ahead of changing conditions.

Precision timing and flawless implementation—where strategy meets reality with institutional-grade infrastructure.

Our live dashboard gives you unrestricted access to performance data, bot activity, and risk metrics.

Select the risk profile that aligns with your goals. You can switch modes anytime as your objectives evolve.

Prioritizes capital preservation with lower volatility. Ideal for risk-averse investors seeking consistent, stable returns.

Balances growth and stability with moderate risk. Suitable for investors comfortable with market fluctuations.

Aggressive strategy targeting highest returns. For experienced investors with high risk tolerance.

Applied only to realized profits

Fees calculated only on new profits above previous peak.

No setup fees, no monthly charges, no hidden costs.

Unlike single-strategy bots, AICT deploys 90 specialized bots that work together, adapting to any market condition in real-time.

Minimum investment starts at $100 to ensure proper diversification across our bot network.

Yes, you maintain full control. Withdrawals are processed within 24-48 hours with no lock-up periods.

Our live dashboard provides real-time visibility into all bot activity, performance metrics, and risk indicators.

Our regime detectors identify volatility shifts and automatically reallocate capital to volatility-optimized bots.

Your funds remain in your own exchange account. We only have API access for trading—never withdrawal permissions.

Yes, you can switch between Steady, Momentum, and Pinnacle modes at any time through your dashboard.

We primarily trade major FX's pairings and cryptocurrency pairs.